Recent Articles

What Does Having Good Credit Mean? A Guide for Timberlane Homebuyers

Discover what “good credit” means in Louisiana with Max Mortgage. Learn scores, impact on rates, and local guidance in Timberlane, Gretna, and New Orleans.

Published on 01/19/2026

What Do You Do With Your Tax Refunds? Smart Strategies for Timberlane Homeowners and Buyers

Turn your Louisiana tax refund into homeownership with Max Mortgage. Down payments, closing costs, rate buy-downs, and smart upgrades in Timberlane/Gretna. Call today.

Published on 01/19/2026

BIG NEWS: Mortgage Rates Are at Their Lowest Level in Years—What That Means for You

Find out what this rate drop means to you for buying a new home.

Published on 01/19/2026

First-Time Buyers in Timberlane: Why Waiting for "Perfect" Rates Could Cost You Thousands

Discover why waiting for the “perfect” rate could cost first-time buyers in Timberlane. Learn a smart, local approach to buying now with Max Mortgage, LLC.

Published on 01/18/2026

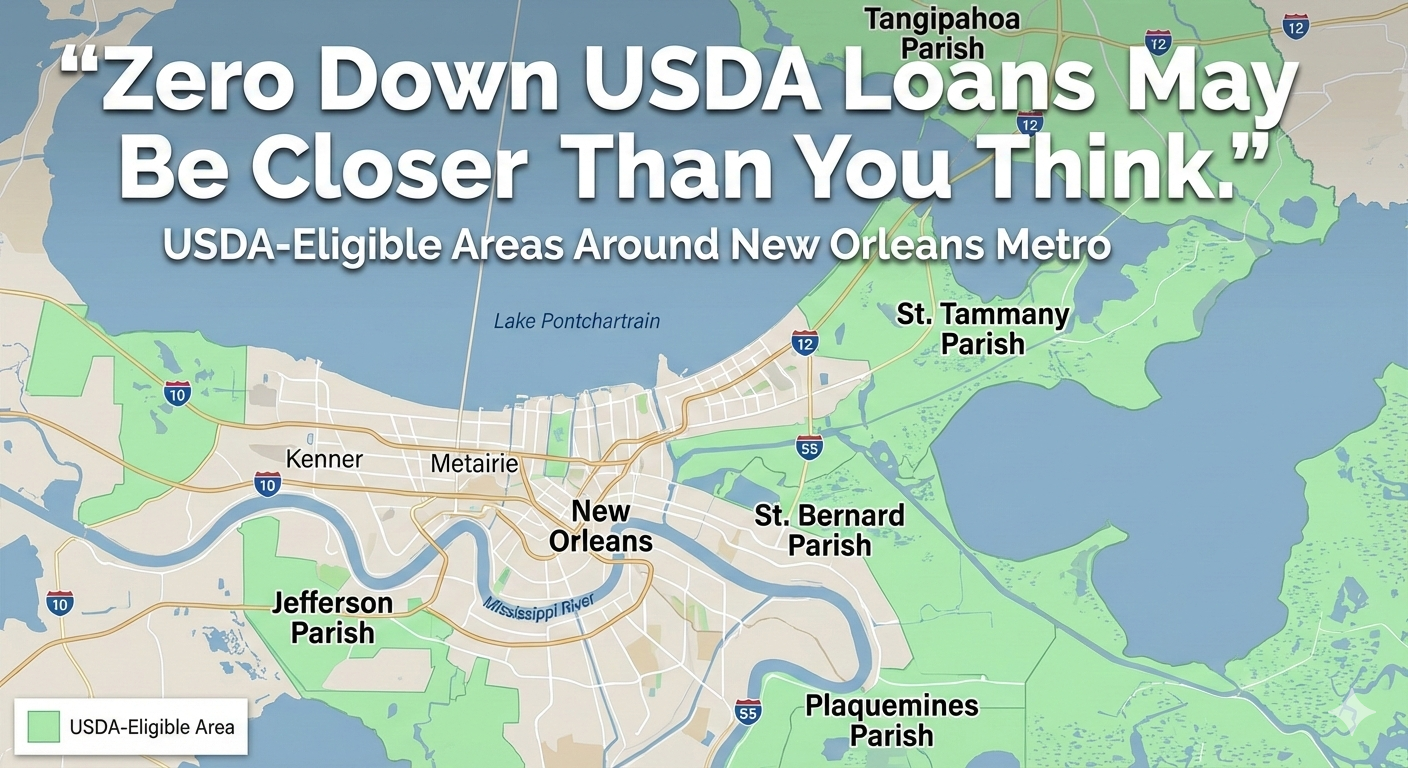

2026 USDA Loan Eligibility in New Orleans and Surrounding Parishes | Zero Down Home Loans

Buying a home with zero down in the New Orleans area may be easier than you think. Learn updated 2026 USDA loan eligibility, income limits, maps, and local tips from a trusted mortgage expert.

Published on 01/16/2026

First-Time Homebuyers in New Orleans: Don't Wait on Rates - Turn Your Tax Refund into the Key to Financial Freedom and Generational Wealth

First-time homebuyers in New Orleans can use their tax refund to buy now instead of waiting on rates. Discover smart strategies for building wealth through homeownership.

Published on 01/13/2026

Lock-in Effect: Something big just happened in the U.S. Housing Market

Find out what the experts are anticipating for 2026 housing

Published on 01/12/2026

Unsecured Business Line of Credit in New Orleans (2026 Guide for Small Businesses)

Learn how unsecured business lines of credit work in New Orleans and surrounding parishes. Eligibility, myths, pros and cons, and how local business owners use them to grow without collateral.

Published on 01/09/2026

2026 FHA Loans in New Orleans & Surrounding Parishes | New Rules, Higher Limits, What Buyers Need to Know

Buying or refinancing in 2026? Learn how updated FHA loan rules, generous loan limits, and New Orleans-specific insurance and flood factors impact first-time buyers, repeat buyers, and homeowners.

Published on 01/02/2026