What Does Having Good Credit Mean? A Guide for Timberlane Homebuyers

Discover what “good credit” means in Louisiana with Max Mortgage. Learn scores, impact on rates, and local guidance in Timberlane, Gretna, and New Orleans.

If you are considering buying a home in Timberlane, Gretna, or anywhere in the Greater New Orleans area, you have likely heard the term "good credit" tossed around more times than you can count. It is the golden ticket of the financial world. But when you strip away the jargon, what does having good credit mean really? Is it just a number, or is it a lifestyle?

At Max Mortgage, LLC, we believe that an educated borrower is an empowered borrower. Whether you are looking to purchase your dream home, refinance an existing loan, or explore reverse mortgage options, understanding your credit health is the first step toward financial freedom. In this comprehensive guide, we will break down the mechanics of credit scores, why they matter for Louisiana residents, and how Charles Parharm and his team can help you navigate the mortgage landscape regardless of where your score currently sits.

The Anatomy of a Credit Score

To understand what "good" credit means, you first need to understand how the score is calculated. Your credit score is essentially a financial report card that lenders use to predict how likely you are to repay a debt. The most commonly used model is the FICO® score, which ranges from 300 to 850.

Your score isn't random; it is calculated based on five specific factors found in your credit report:

Payment History (35%): This is the biggest chunk. Do you pay your bills on time? Late payments, bankruptcies, and charge-offs can significantly damage this section.

Amounts Owed (30%): This looks at your credit utilization ratio. If you have a credit card with a $10,000 limit and you have a $9,000 balance, your utilization is high, which can lower your score.

Length of Credit History (15%): Lenders like to see a long track record. This considers the age of your oldest account, the age of your newest account, and the average age of all accounts.

New Credit (10%): Opening several credit accounts in a short period of time represents a greater risk—especially for people who do not have a long credit history.

Credit Mix (10%): This looks at your portfolio of credit cards, retail accounts, installment loans (like car loans), and mortgage loans.

Credit Score Ranges: Where Do You Stand?

So, what is the magic number? While different lenders have different criteria, FICO scores are generally categorized into ranges. Knowing where you fall on this spectrum is crucial before applying for loan programs.

Credit Score Range Rating What It Means for Borrowers 800 - 850 Exceptional You are a "prime" borrower. You will likely qualify for the lowest interest rates and best terms available. 740 - 799 Very Good You have demonstrated responsible credit behavior. You are likely to receive better-than-average rates. 670 - 739 Good This is the median range. You are considered an "acceptable" borrower. You will qualify for most loans, though perhaps not at the rock-bottom rates. 580 - 669 Fair You may be considered a subprime borrower. You can still qualify for loans, particularly FHA loans, but you may pay higher interest. 300 - 579 Poor Credit is significantly damaged. It may be difficult to obtain unsecured credit, and mortgage options may require higher down payments or specific programs.

Why Good Credit Matters in Timberlane and New Orleans

Having good credit means more than just bragging rights. In the real world—specifically here in Louisiana, Texas, and Alabama—it translates to tangible financial savings. Here is why striving for that "Very Good" or "Exceptional" range is worth the effort:

1. Lower Mortgage Interest Rates

This is the most significant impact. A difference of just 50 points on your credit score can change your interest rate by a full percentage point or more. Over the life of a 30-year mortgage, this can equate to tens of thousands of dollars in savings. When you apply for a mortgage, lenders use your score to determine the "risk" of lending to you. Lower risk equals lower rates.

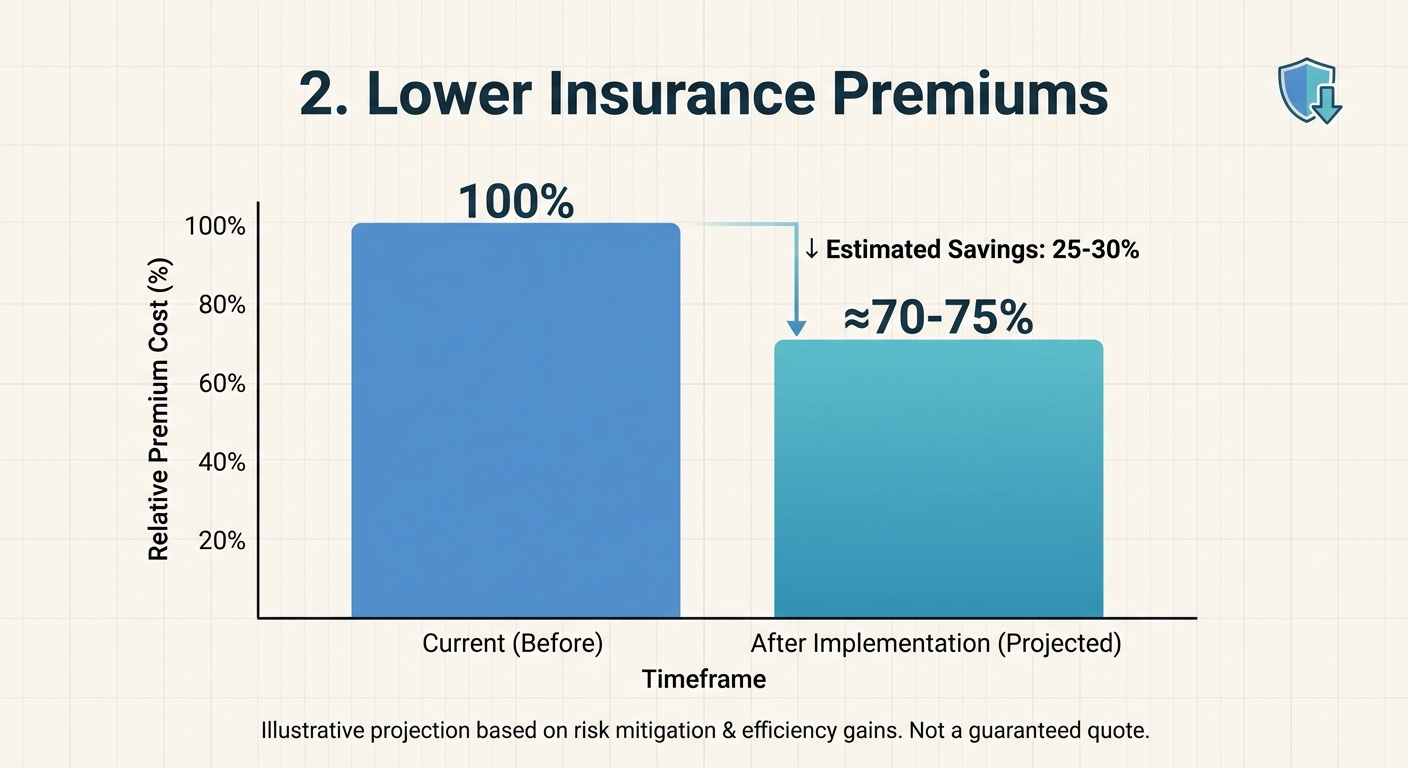

2. Lower Insurance Premiums

3. Easier Approval for Rentals

Not ready to buy yet? Landlords in Gretna and Harvey check credit too. Good credit implies you are a reliable tenant who will pay rent on time.

4. Better Terms on Auto Loans and Credit Cards

Can I Buy a House Without "Perfect" Credit?

Absolutely. This is a common misconception. While having an 800 credit score is fantastic, it is not a requirement for homeownership.

At Max Mortgage, LLC, we specialize in a variety of loan products designed for different financial situations:

FHA Loans: These are popular among first-time homebuyers in Louisiana. They allow for lower credit scores (often down to 580 with a 3.5% down payment) and are more forgiving of past credit issues.

VA Loans: For our veterans in Timberlane and beyond, VA loans offer incredible benefits, often with no minimum credit score requirement set by the VA (though lenders may have their own overlays).

USDA Loans: For eligible rural and suburban areas, these loans offer 0% down payment options.

If you are worried about your credit standing, don't rule yourself out. Contact Charles Parharm today. We can review your unique situation and guide you toward the program that fits your needs.

Actionable Tips to Build and Maintain Good Credit

Check Your Credit Report: Errors happen. You are entitled to a free credit report annually from the major bureaus. Check for mistakes and dispute them immediately.

Pay Everything on Time: Set up automatic payments for the minimum amount due on all your credit cards to ensure you never miss a deadline.

Lower Your Utilization: Try to keep your credit card balances below 30% of your limit. If you can, pay down high-interest debt first.

Don't Close Old Accounts: Even if you don't use that old credit card anymore, keeping it open helps the "Length of Credit History" portion of your score.

Limit Hard Inquiries: Don't apply for multiple credit cards or loans right before applying for a mortgage. This can temporarily dip your score.

The Local Advantage: Working with Max Mortgage, LLC

Understanding credit is one thing; applying that knowledge to the local real estate market in Timberlane, Louisiana, is another. When you work with a national call center, you are just a file number. When you work with Max Mortgage, LLC, you are working with a neighbor.

Charles Parharm has years of experience helping families in Louisiana, Texas, and Alabama realize the dream of homeownership. We understand the specific challenges of our local market—from flood zones to insurance costs—and we know how to structure loans to get you to the closing table, regardless of where your credit score starts.

We offer a transparent loan process and utilize modern technology to make your application as efficient as possible, without sacrificing the personal touch.

Ready to Check Your Buying Power?

Don't let questions about your credit score keep you on the sidelines. Good credit means having options, and at Max Mortgage, LLC, we are here to help you explore them.

Take the first step toward your new home today.

Get Your Custom Rate Quote Now!

Or call us directly at (504) 584-8999 to speak with Charles Parharm about your goals.

Frequently Asked Questions (FAQs)

1. What is the minimum credit score needed to buy a house in Louisiana?

There is no single "minimum" because it depends on the loan type. Generally, Conventional loans require a score of 620 or higher. However, FHA loans can be approved with scores as low as 580 (with a 3.5% down payment) or even lower with a larger down payment (10%). VA and USDA loans also have flexible credit requirements. It is best to consult with a lender to see what you qualify for.

2. How long does it take to improve my credit score?

It depends on what is hurting your score. If you simply have high balances, paying them down can boost your score within 30 to 45 days (after the credit card issuer reports the new balance). However, recovering from major negative events like a bankruptcy or foreclosure can take several years. Consistent, positive behavior is the key.

3. Will checking my own credit hurt my score?

No. When you check your own credit, it is considered a "soft inquiry," which does not impact your score. A "hard inquiry" only happens when a lender checks your credit to make a lending decision. You should monitor your credit regularly to ensure accuracy.

4. Does having no credit mean I have bad credit?

Not necessarily, but it does make it harder for lenders to assess your risk. Having "no credit" means you have a thin file. In some cases, lenders can use "non-traditional" credit references, such as proof of rent payments, utility bills, or insurance payments, to build a credit profile for a mortgage application.

5. Can I get a mortgage if I have a lot of student loan debt but good credit?

Yes! Lenders look at your Debt-to-Income (DTI) ratio, not just your total debt amount. If your income is sufficient to cover your student loan payments plus a new mortgage payment, and you have a good credit history, you can certainly qualify for a home loan.

The content provided in this blog post is for informational purposes only and does not constitute financial or legal advice. Max Mortgage, LLC is an Equal Housing Opportunity.

Max Mortgage, LLC

419 Lapalco Blvd, Gretna, LA 70056

NMLS: 1446745

Phone: (504) 584-8999 | Email: charles@callthemax.com