What Do You Do With Your Tax Refunds? Smart Strategies for Timberlane Homeowners and Buyers

Turn your Louisiana tax refund into homeownership with Max Mortgage. Down payments, closing costs, rate buy-downs, and smart upgrades in Timberlane/Gretna. Call today.

It’s that time of year again. W-2s are arriving in mailboxes, accountants are crunching numbers, and for many Americans, a significant check from Uncle Sam is on the horizon. The average tax refund often hovers around $3,000, which can feel like a sudden windfall. The temptation to splurge on a tropical vacation, a new massive television, or a shopping spree at the mall is incredibly strong.

But before you book that flight or swipe your card, take a moment to consider your long-term financial health. At Max Mortgage, LLC, we believe your tax refund is more than just "bonus money"—it is a powerful tool that can help you build generational wealth, secure a new home in Timberlane, Louisiana, or solidify your financial foundation.

Whether you are a first-time homebuyer looking in Gretna and Harvey, or a seasoned homeowner looking to maximize your equity, here is a comprehensive guide on how to strategically utilize your tax refund.

1. The Ultimate Investment: Use It for a Down Payment

One of the biggest hurdles for aspiring homeowners is saving for the down payment. Many potential buyers believe they need 20% down to buy a home, but that is a myth. With government-backed loans like FHA loans, you may only need as little as 3.5% down.

If you receive a refund of $3,500, that covers a significant portion—if not all—of the down payment for a starter home in many parts of Louisiana. By combining your tax refund with our specialized loan programs, you can stop renting and start owning.

Boost Your Buying Power

Even if you already have some savings, adding your tax refund to the pot can change your loan terms. A larger down payment can:

Lower your monthly mortgage payments.

Reduce or eliminate the need for Private Mortgage Insurance (PMI).

Help you qualify for a better interest rate.

If you are looking to buy in the beautiful Timberlane community or surrounding Westbank areas, Charles Parharm and the team at Max Mortgage can help you calculate exactly how far that refund will take you.

2. Cover Your Closing Costs

When buying a home, the down payment isn't the only expense. You also have to consider closing costs, which include appraisal fees, title insurance, and origination fees. These can typically range from 2% to 5% of the loan amount.

Using your tax refund to cover these costs ensures that your personal savings remain intact for moving expenses or emergency funds. It makes the transition from tenant to homeowner much smoother and less stressful.

3. Buy Down Your Interest Rate (Discount Points)

In the current mortgage environment, interest rates are a hot topic. Did you know you can use your tax refund to permanently lower your interest rate? This is called "paying points."

One "point" is equal to 1% of your loan amount. By paying this upfront (using your refund), you can lower your interest rate for the life of the loan. This strategy can save you tens of thousands of dollars in interest over a 30-year term. Visit our Mortgage Basics page to learn more about how interest rates and points work.

4. Invest in High-ROI Home Improvements

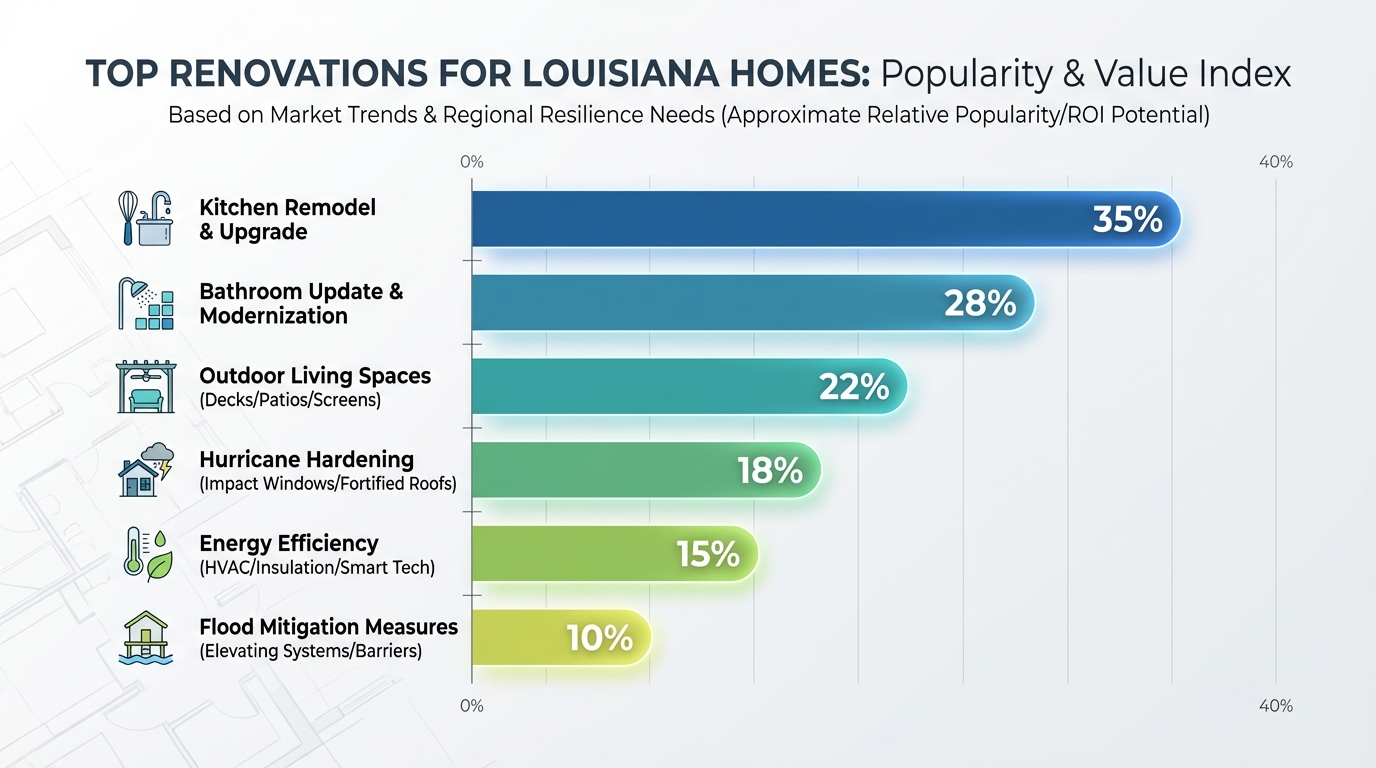

If you already own a home in Timberlane, Gretna, or New Orleans, your tax refund is the perfect funding source for renovations that increase property value. However, not all renovations are created equal. You want to focus on projects that offer a high Return on Investment (ROI).

Top Renovations for Louisiana Homes:

Kitchen Updates: You don't need a full remodel. New hardware, a backsplash, or energy-efficient appliances can modernize the space.

Curb Appeal: Fresh landscaping, a new front door, or pressure washing the driveway makes a massive difference in appraisal value.

Energy Efficiency: Given the heat in Louisiana, upgrading insulation or installing a smart thermostat can lower utility bills immediately.

Storm Prep: As we discussed in our recent blog about Homeowners Insurance Costs, fortifying your roof or adding storm shutters can sometimes lower your insurance premiums.

5. Pay Down High-Interest Debt

Create a professional Top Renovations for Louisiana Homes: bar chart visualization. Modern, clean de

If you have credit card debt with high interest rates (often 20% or more), using your tax refund to pay off or significantly reduce that balance is a guaranteed return on investment. It improves your credit score and lowers your DTI, making you a more attractive borrower for a refinance or a new purchase.

6. Start an Emergency Home Repair Fund

Parking your tax refund in a high-yield savings account designated strictly for "Home Repairs" gives you peace of mind. It ensures that when something breaks, you can fix it immediately without financial stress, preserving the value of your asset.

Comparison: Spending vs. Investing Your Refund

Let's look at the real-world impact of how you use a hypothetical $3,000 tax refund.

Action Immediate Gratification Long-Term Value (5 Years) Financial Impact Luxury Vacation High (1 week of fun) Zero -$3,000 (Money is gone) Shopping Spree Medium (New clothes/gadgets) Low (Items depreciate) -$2,500 (Resale value is low) Pay Down Credit Card Low (Relief) High (Credit score boost) +$4,500+ (Saved interest payments) Mortgage Down Payment High (New Home) Very High (Equity build) +$15,000+ (Appreciation & Principal paydown)

Why Timberlane, Louisiana is the Place to Invest

If you are considering using your refund to enter the real estate market, Timberlane in Gretna is a prime location. Known for its established community feel, proximity to the golf course, and easy access to downtown New Orleans via the Crescent City Connection, it offers a blend of suburban peace and city convenience.

Real estate in the 70056 zip code continues to be a solid investment. By using your tax refund to buy into this market now, you are securing a foothold in a community that retains value. Max Mortgage, located right here on Lapalco Blvd, understands the specific nuances of the Timberlane and Westbank market better than anyone.

How Max Mortgage Can Help You Maximize Your Refund

At Max Mortgage, LLC, we don't just process loans; we act as your financial advisors. Charles Parharm and his team can sit down with you to review your tax refund amount and determine the best strategic move.

We can show you:

Rent vs. Buy Analysis: Is your refund enough to stop renting?

Refinance Options: Can you use the refund to close on a refinance that lowers your monthly payment?

Credit Repair: How to use the cash to boost your score quickly.

Don't let your refund disappear into everyday expenses. Let us help you turn it into a permanent asset.

Frequently Asked Questions (FAQs)

1. Can I use my tax refund as a down payment on a house immediately?

Yes, absolutely. A tax refund is considered an acceptable source of funds for a down payment by almost all lenders, including for FHA, VA, and Conventional loans. Because the source is the government (IRS), it is easy to document and verify, which simplifies the underwriting process.

2. Do I need to provide documentation of my tax refund to the lender?

Yes. Lenders need to track the source of all funds used for closing. You will likely need to provide a copy of your tax return and a bank statement showing the deposit of the refund. If the money hasn't been deposited yet, providing the tax return showing the expected amount is often a good start for pre-qualification.

3. Is it better to pay off debt or save for a down payment with my refund?

This depends on your specific financial picture. If you have high-interest debt (like credit cards at 20%+ APR), paying that down might be better to improve your DTI ratio and credit score, which gets you a better mortgage rate. If your debt is manageable, using the cash for a down payment to stop paying rent is often the superior long-term wealth builder. Contact us for a free consultation to analyze your specific scenario.

4. If I have bad credit, can my tax refund help me get a loan?

Your refund can certainly help! You can use the funds to pay off collections or reduce credit card balances, which can rapidly improve your credit score. Additionally, having a larger down payment (funded by your refund) can sometimes offset a lower credit score in the eyes of an underwriter. Max Mortgage specializes in helping borrowers with various credit profiles.

5. Can I use my tax refund to buy an investment property in Timberlane?

Yes. If you already own a primary residence, your tax refund can serve as the down payment (or part of it) for an investment property. Real estate in the Gretna and Timberlane area is a popular choice for investors looking for rental income. Note that investment properties typically require a higher down payment (often 15-20%) than primary residences.

Ready to Make Your Move?

Your tax refund is an opportunity - don't waste it. Whether you are looking to buy your first home in Timberlane, refinance your current mortgage, or explore reverse mortgage options, Max Mortgage, LLC is here to guide you.

Contact Charles Parharm today to discuss your options.

Phone: (504) 584-8999

Email: charles@callthemax.com

Address: 419 Lapalco Blvd, Gretna, LA 70056

CLICK HERE TO GET STARTED AND MAXIMIZE YOUR REFUND!

Max Mortgage, LLC | NMLS: 1446745 | Charles H. Parharm, Jr. | Equal Housing Opportunity