2026 USDA Loan Eligibility in New Orleans and Surrounding Parishes | Zero Down Home Loans

Buying a home with zero down in the New Orleans area may be easier than you think. Learn updated 2026 USDA loan eligibility, income limits, maps, and local tips from a trusted mortgage expert.

2026 USDA Loan Eligibility in New Orleans and Surrounding Parishes

What Local Homebuyers and Realtors Need to Know About Zero Down Financing

If you have been told you need a large down payment to buy a home in the New Orleans area, you may have been given incomplete information.

For many first-time buyers across Southeast Louisiana, USDA Guaranteed Loans offer a legitimate path to homeownership with zero down payment, competitive interest rates, and flexible guidelines. The challenge is that most buyers and even some real estate agents do not fully understand where USDA loans work, who qualifies, or what changed recently.

As a mortgage professional with over 20 years of experience helping Louisiana buyers, I see this confusion every week. This guide breaks down what matters most for 2026 USDA loan eligibility, with a clear focus on the New Orleans metro and surrounding parishes.

What Is a USDA Guaranteed Loan

A USDA Guaranteed Loan is a government-backed mortgage program offered through the United States Department of Agriculture. It is designed to help low-to-moderate income households purchase a primary residence in eligible areas.

Key features include:

Zero down payment required

Competitive fixed interest rates

Lower monthly mortgage insurance than FHA in many cases

Flexible credit guidelines compared to conventional loans

USDA loans are for home purchases only and must be owner-occupied. They are especially powerful for first-time buyers who have steady income but limited savings.

Why USDA Loans Matter in the New Orleans Area

Many buyers assume USDA loans do not apply anywhere near New Orleans. That assumption is one of the biggest missed opportunities in our market.

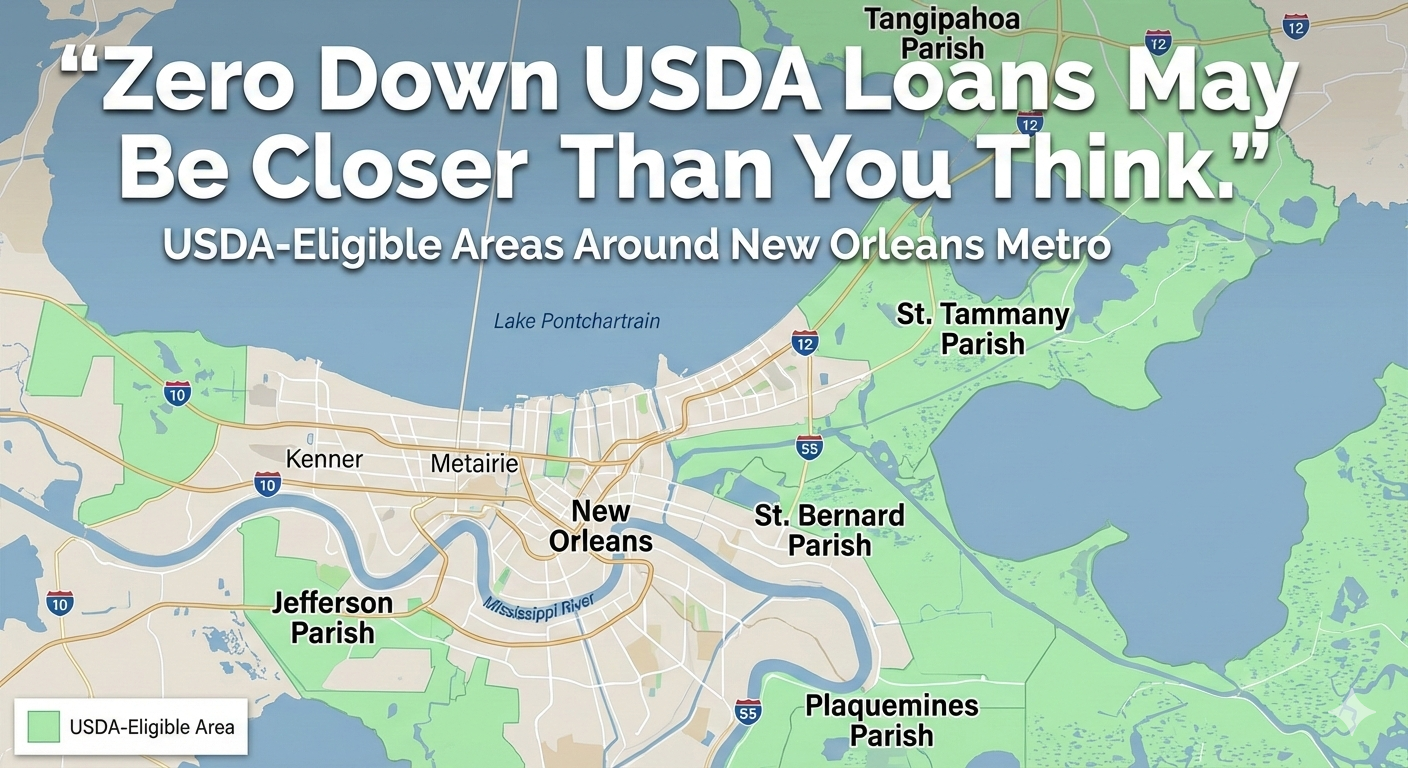

Large portions of Jefferson Parish, St. Tammany Parish, St. Bernard Parish, Plaquemines Parish, Tangipahoa Parish, and surrounding areas remain USDA-eligible. Some neighborhoods that feel suburban, not rural, still qualify.

Local Insight

In Southeast Louisiana, USDA eligibility often comes down to street-by-street mapping, not parish-wide assumptions. Two homes a mile apart can have different eligibility outcomes.

2026 USDA Eligibility Updates You Should Know

Updated Eligibility Maps

USDA eligibility maps were updated following census data changes. Some areas were removed, but many surrounding New Orleans communities remain eligible. Buyers should always check the exact property address rather than relying on general assumptions.

Increased Income Limits

Income limits increased again, allowing more middle-income households to qualify. Many buyers who were previously over the limit now fall within USDA guidelines for 2026.

This is especially relevant for:

Dual-income households

Teachers, nurses, first responders

Buyers relocating from higher-cost rentals

What This Means for You in the New Orleans Area

If you are renting and struggling to save for a down payment, USDA loans can shift the math dramatically.

Instead of waiting years to save 3 to 5 percent down, you may be able to:

Purchase sooner

Keep savings for reserves and moving costs

Offset higher insurance or flood-related expenses

For real estate partners, understanding USDA eligibility expands the buyer pool and helps deals move forward that might otherwise stall.

USDA Loan Requirements Simplified

Basic Eligibility Checklist

Primary residence only

Property must be in an eligible area

Household income within USDA limits

Stable employment and income

Acceptable credit history

Credit Score Questions

Many lenders look for a 640 credit score, but exceptions can exist depending on the full profile. Credit is reviewed in context, not isolation.

Common Questions Buyers Are Asking

What credit score do I need for a USDA loan

Most lenders prefer a 640 score, but compensating factors such as low debt or strong reserves can help in some cases.

What are the USDA income limits in Louisiana

Income limits vary by household size and county. Many New Orleans area buyers are surprised to learn they qualify even with solid professional incomes.

Which areas near New Orleans qualify for USDA loans

Parts of Jefferson Parish, St. Tammany Parish, St. Bernard Parish, Plaquemines Parish, and Tangipahoa Parish commonly qualify. Exact address checks are essential.

What disqualifies a home from USDA financing

The home must meet safety and livability standards and be located in an eligible area. Condos and mixed-use properties can be more restrictive.

Is USDA harder than FHA

USDA is different, not harder. It has income and location rules, but often offers better long-term affordability due to lower mortgage insurance.

Myth-Busting USDA Loans in Louisiana

Myth: USDA loans are only for farmland

Reality: Many suburban neighborhoods near New Orleans qualify.

Myth: You must be low income

Reality: Moderate-income households often qualify due to updated limits.

Myth: USDA takes too long

Reality: With proper preparation, timelines are very manageable.

Simple Action Plan for Buyers

Get your income reviewed properly

Check property eligibility by exact address

Review credit and debt structure

Understand insurance and flood zone impact

Get pre-approved before shopping

FAQs for New Orleans Area Buyers

Can I use USDA if I owned a home before

Yes, as long as you meet eligibility and it is your primary residence.

Are closing costs higher with USDA loans

Closing costs are similar to other loans and may be negotiated with the seller.

Does USDA allow seller concessions

Yes, within limits.

Can I combine USDA with local assistance programs

Sometimes, depending on the program and structure.

Is USDA available inside Orleans Parish

Most of Orleans Parish is ineligible, but surrounding areas often qualify.

Soft Next Steps

If you want clarity before you shop, a short conversation can save months of frustration.

Book a Consultation

Want to understand your real monthly payment before you shop?

Let's walk through insurance, flood risk, taxes, and financing options together.

📅 Schedule here: https://api.leadconnectorhq.com/widget/bookings/talk-with-charles

Start Your Application

Ready to begin?

📝 Apply here: https://1446745.my1003app.com/1413036/register

Have questions?

📱 Call us at 504-584-8999.

Compliance

All loans subject to approval. Equal Housing Opportunity.