Where Will You Be in 10 Years? A Financial Look at Renting vs. Buying in Timberlane, LA

Plan your 10-year financial future with homeownership in Timberlane, Gretna, and New Orleans. Max Mortgage shows how buying beats renting.

Close your eyes for a moment and fast-forward. The year is 2035. You are ten years older. Perhaps your family has grown, your career has advanced, or you are thinking about retirement. Now, look at your living situation. Do you own the roof over your head, or are you still negotiating lease renewals?

At Max Mortgage, LLC, we believe that looking at a home purchase through a 10-year lens is the best way to understand the true value of homeownership. While the immediate monthly payment is important, the long-term wealth accumulation is where the magic happens. For residents in Timberlane, Gretna, and the greater New Orleans area, the choice between signing another lease and purchasing a home is about much more than just a place to sleep—it is a decision that defines your financial future.

Let’s break down exactly where you could be in 10 years depending on which path you choose.

The Renter’s Path: The Cycle of Rising Costs

Renting offers flexibility, which can be great in the short term. However, over a decade, that flexibility comes at a steep premium. If you choose to rent for the next 10 years in the Timberlane or Westbank area, here is the financial reality you likely face:

Zero Equity: After 120 months of payments, you will have paid off your landlord’s mortgage, not yours. You leave with nothing.

Inflation Vulnerability: Rents generally rise with inflation. A rent of $2,000 today, assuming a conservative 3-5% annual increase, could easily balloon to over $3,000 per month by year 10.

Instability: Landlords can sell the property, decide to move back in, or change terms, forcing you to move when you aren't ready.

As Charles Parharm, your local Mortgage Loan Advisor, often notes: "Rent is the only loan with an interest rate of 100%—because you never get a single penny of the principal back."

The Homeowner’s Path: The Wealth Building Machine

Now, let’s look at the homeowner. If you buy a home in Timberlane or the surrounding Jefferson Parish area today, where are you in 10 years?

1. You Have "Forced Savings" (Principal Paydown)

Every month you make a mortgage payment, a portion goes toward interest, but another portion goes toward paying down your principal balance. This is equity you are building simply by living in your home. Over 10 years, that principal reduction adds up to tens of thousands of dollars in pure net worth.

2. You Benefit from Appreciation

Real estate has historically appreciated over time. While markets fluctuate, the 10-year trend is almost invariably upward. Even modest appreciation on a home in Timberlane means your asset is growing in value while your loan balance shrinks.

3. Your Housing Costs are Stabilized

With a fixed-rate mortgage, your principal and interest payment never changes. While taxes and insurance may fluctuate, your core housing expense remains locked in. In 2036, you will likely be paying the same mortgage rate you locked in today, while renters around you are paying vastly inflated market rates.

The 10-Year Comparison: By The Numbers

Let’s look at a hypothetical comparison for a property in the Timberlane/Gretna area. We will compare renting a home for $2,200/month versus buying a similarly priced home.

Category Renting (10 Years) Buying (10 Years) Monthly Payment Year 1 $2,200 $2,200 (Est. P&I + Taxes/Ins) Monthly Payment Year 10 $2,956 (Assuming 3% annual rent hike) $2,200 (Fixed Mortgage Payment)* Total Cash Spent ~$306,000 ~$264,000 (plus maintenance) Asset Value Year 10 $0 ~$403,000 (Assuming 3% appreciation) Remaining Loan Balance N/A Lower than purchase price due to paydown Net Worth Created $0 $150,000+ (Equity + Appreciation)

*Note: Taxes and insurance may vary over time. This is a hypothetical illustration for educational purposes.

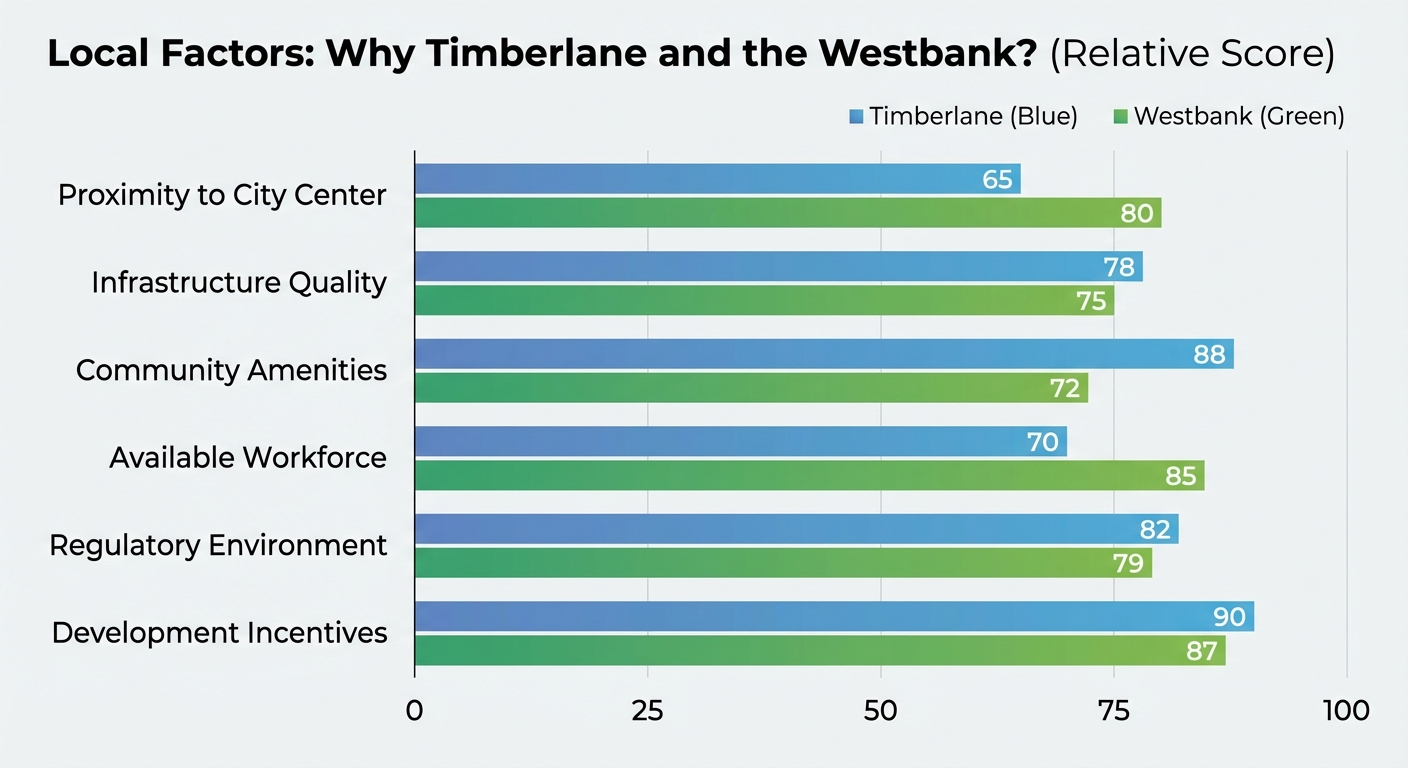

Local Factors: Why Timberlane and the Westbank?

When asking "Where are you in 10 years?", the where matters just as much as the when. Timberlane and the broader Westbank area offer unique advantages for long-term homeowners compared to other parts of the New Orleans metro.

Insurance and Flood Zones

We know that homeowners insurance is a major topic in Louisiana. As detailed in our recent Guide to New Orleans Homeowners Insurance Costs, the Westbank often benefits from having neighborhoods in "X" flood zones, which can sometimes result in more manageable premiums compared to other parishes. Securing a home in a stable flood zone now protects your long-term affordability.

Community Stability

Barriers to Entry: "I Can't Buy Yet"

Many people stick to renting because they believe they cannot qualify for a mortgage. They think they need a 20% down payment or perfect credit. In reality, the landscape of lending has changed.

At Max Mortgage, LLC, we offer a variety of loan programs designed to get you into a home sooner:

FHA Loans: Great for first-time buyers, requiring as little as 3.5% down and allowing for more flexible credit scores.

VA Loans: For our veterans in the Gretna and Belle Chasse area, this offers 0% down payment options.

USDA Loans: Available in designated rural areas, offering 100% financing.

If you are worried about your credit, don't guess—check. Visit our Mortgage Basics page to understand how credit scores impact your buying power, or contact us for a review.

The "Age in Place" Perspective

Looking even further ahead—20 or 30 years—owning a home gives you the ultimate security: the ability to "Age in Place." As you approach retirement, owning your home outright eliminates your largest monthly expense. For those already in retirement, owning a home opens the door to a Reverse Mortgage, which can convert home equity into tax-free cash flow to support your lifestyle.

How to Start Your 10-Year Journey Today

You cannot reach that 10-year goal of wealth and stability if you don't take the first step today. The process is simpler than you might think:

Get Pre-Qualified: Know your numbers. Use our Pre-Qualification tool to see how much home you can afford.

Consult a Local Expert: Talk to Charles Parharm. We understand the nuances of the Timberlane and New Orleans market, from taxes to insurance.

Shop with Confidence: With a pre-approval letter in hand, you are a serious buyer ready to make an offer.

Frequently Asked Questions

1. Is it better to rent or buy in Timberlane, LA right now?

While interest rates fluctuate, buying is generally the better long-term financial strategy in Timberlane due to the accumulation of equity and tax benefits. Renting offers 0% return on investment. If you plan to stay in the area for at least 3-5 years, buying usually wins out mathematically.

2. Do I really need a 20% down payment to buy a house?

No. This is a common myth. Programs like FHA loans require only 3.5% down, and VA or USDA loans can require 0% down. We can help you find down payment assistance programs if you qualify.

3. What happens if home values drop after I buy?

Real estate markets are cyclical. While values can dip in the short term, history shows that over a 10-year period, real estate generally appreciates. Unlike stocks, you also get the utility of living in the asset while it recovers.

4. Rent includes maintenance; buying doesn't. Doesn't that make renting cheaper?

Maintenance is a cost of ownership, yes. However, landlords factor maintenance costs into your rent—so you are paying for it anyway, plus the landlord's profit margin. When you own, you control the maintenance costs and can make upgrades that increase the property's value.

5. How do I know if I qualify for a loan?

The best way is to speak with a Mortgage Loan Advisor. We can review your income, credit, and assets to give you a clear picture. You can start by visiting our Apply Now page to get the process started securely.

Take Control of Your Future Today

Ten years will pass regardless of what you decide. The question is, will you spend those years paying off someone else's mortgage, or building your own net worth?

If you are ready to explore homeownership in Timberlane, Gretna, or anywhere in the Greater New Orleans area, Max Mortgage, LLC is here to guide you with education-first advice.

Contact Charles Parharm today to start your journey.

Call us at: (504) 584-8999

Email: charles@callthemax.com

Click Here to Schedule a Free Consultation

Max Mortgage, LLC | NMLS #1446745 | Charles H. Parharm, Jr. NMLS #1413036

419 Lapalco Blvd, Gretna, LA 70056

This is not a commitment to lend. All loans are subject to credit approval and property appraisal. Programs, rates, terms and conditions are subject to change without notice. Equal Housing Opportunity.