Home Ownership is the Beginning of Financial Freedom and Generational Wealth in Louisiana

Unlock financial freedom with homeownership in Timberlane, Gretna, and Greater New Orleans. Learn how good credit boosts your buying power with Max Mortgage.

For many residents in Timberlane, Gretna, and the greater New Orleans area, the concept of the "American Dream" is synonymous with owning a home. However, homeownership is more than just a cultural milestone or a place to hang your hat. It is arguably the most powerful vehicle for building financial freedom and establishing generational wealth available to the average family.

At Max Mortgage, LLC, we believe that buying a home is not merely a transaction; it is a pivotal financial strategy. Whether you are looking at a charming starter home in Harvey or a forever home in the established neighborhoods of Timberlane, understanding the long-term economic impact of this decision is crucial. In this comprehensive guide, we will explore how transitioning from renter to homeowner can secure your financial future and create a legacy for your children.

The Gap Between Renting and Owning

To understand why homeownership is the cornerstone of wealth, one must first look at the economics of renting. When you rent a property, 100% of your monthly payment goes toward your landlord's mortgage and equity. You are effectively paying for someone else's financial freedom. Once the month is over, that money is gone, providing you with shelter but zero return on investment.

Conversely, a mortgage payment acts as a "forced savings account." A portion of every payment you make reduces the principal balance of your loan, increasing your ownership stake or equity in the property. Over time, this equity grows, becoming a significant asset that can be leveraged for future financial moves.

The Net Worth Difference

According to data from the Federal Reserve, the net worth of a homeowner is significantly higher than that of a renter. In fact, on average, a homeowner's net worth is over 40 times greater than that of a renter. This disparity isn't accidental; it is the result of two powerful economic forces working in the homeowner's favor: amortization and appreciation.

How Real Estate Builds Wealth: The Mechanics

Financial freedom is rarely achieved through wages alone; it requires assets that grow in value. Here is how owning a home in Louisiana works to build your personal balance sheet:

Principal Paydown (Amortization): In the early years of a fixed-rate mortgage, a larger portion of your payment goes toward interest. However, with every single payment, the amount going toward the principal increases. Over 15 or 30 years, you are systematically eliminating debt and converting it into an asset.

Appreciation: Historically, real estate values rise over time. While the market can fluctuate in the short term, the long-term trend is upward. If you purchase a home in Timberlane for $300,000 and it appreciates at a conservative rate of 3% per year, that property could be worth significantly more in a decade, without you having to invest an extra dime.

Tax Advantages: Homeownership unlocks tax benefits that renting cannot offer. Mortgage interest and property taxes are often tax-deductible (consult your tax professional), which effectively lowers the cost of borrowing and keeps more money in your pocket annually.

Fixed Housing Costs: Rents in New Orleans and Jefferson Parish rise with inflation. A fixed-rate mortgage locks in your principal and interest payment for the life of the loan. As your income likely increases over your career, your housing cost remains stable, freeing up more cash flow for investments and savings.

Defining Generational Wealth Through Real Estate

Generational wealth refers to assets that are passed down from one generation to the next, providing financial security and opportunities to children and grandchildren. Real estate is often the primary asset transferred in these scenarios.

When you own a home, you are not just securing your own retirement; you are creating a stepping stone for your heirs. Here is how homeownership facilitates this legacy:

1. The Step-Up in Basis

Under current tax laws, when heirs inherit a property, they often receive a "step-up in basis." This means the value of the property is adjusted to its current market value at the time of inheritance, potentially saving your heirs significant amounts in capital gains taxes if they choose to sell.

2. Funding Education and Entrepreneurship

The equity built in a family home can be tapped into via a Cash-Out Refinance or a Home Equity Line of Credit (HELOC). Parents often use this accumulated wealth to fund their children's college education without crippling student loans or to provide seed money for a child's business venture. This gives the next generation a head start that renters cannot provide.

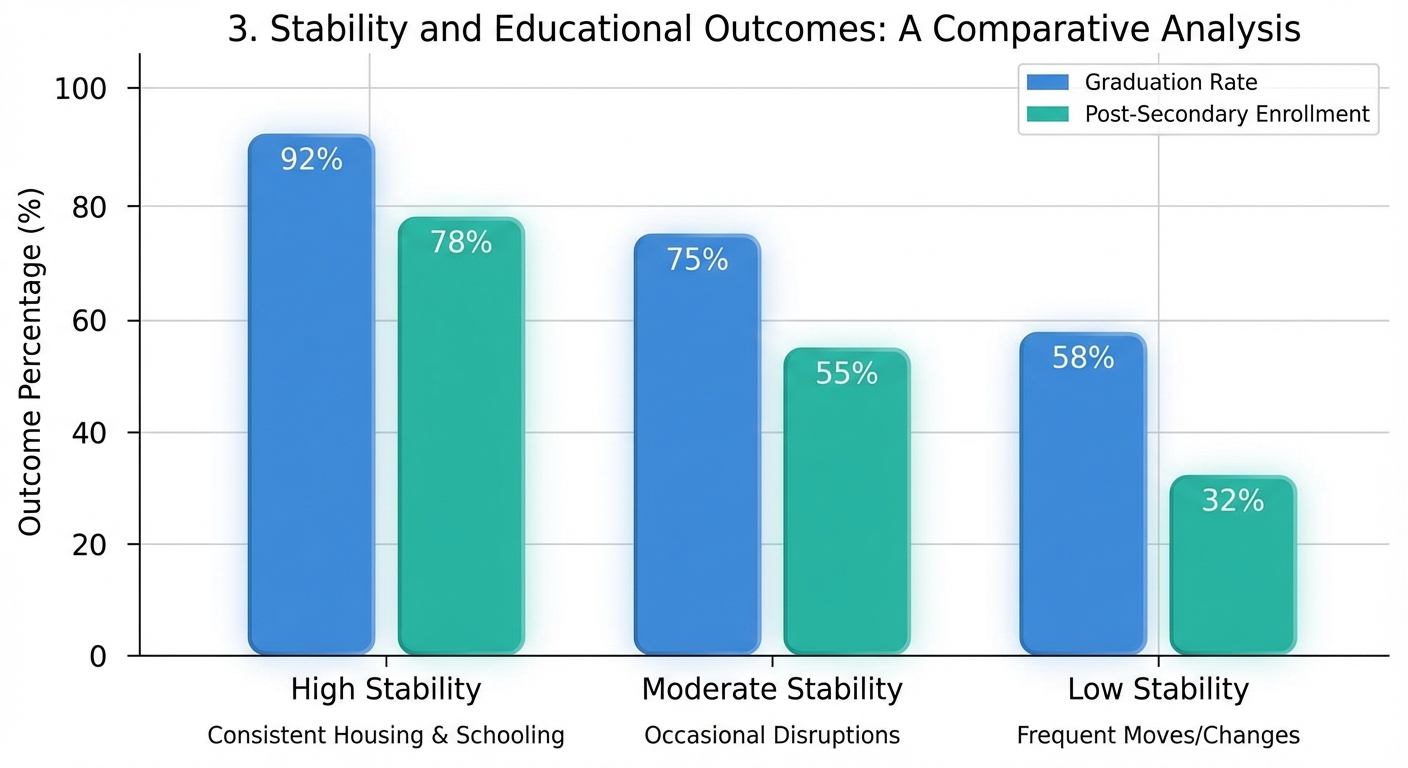

3. Stability and Educational Outcomes

Local Spotlight: Investing in Timberlane and Jefferson Parish

While the principles of wealth building apply everywhere, real estate is hyper-local. Timberlane, located in Gretna, Louisiana, represents a prime opportunity for families looking to balance lifestyle with investment potential.

Timberlane offers a unique value proposition. It provides the space and community feel of a suburb while being minutes away from the economic hub of New Orleans. By purchasing in a desirable area like Timberlane, or nearby Harvey and Terrytown, you are investing in a market that has shown resilience and steady demand.

However, buying in our region requires local expertise. As noted in our recent guide to homeowners insurance, factors like flood zones and insurance premiums can impact your monthly budget. Working with a local expert like Charles Parharm ensures you aren't just buying a house, but buying the right house with a sustainable financial structure.

Comparison: Renting vs. Owning Over 10 Years

Category Renter Homeowner Monthly Cost (Year 1) $2,000 (Rent) $2,000 (Mortgage P&I + Taxes/Ins) Housing Cost Trend Increases ~3-5% annually Fixed P&I (Taxes/Ins may vary) Total Payments (10 Years) ~$275,000 (Estimated with increases) ~$240,000 Asset Value after 10 Years $0 $380,000+ (Assuming appreciation) Debt Remaining $0 ~$240,000 Net Equity (Wealth Created) $0 ~$140,000

*Note: This is a hypothetical illustration. Actual figures depend on interest rates, down payments, insurance costs, and market conditions. Contact Max Mortgage, LLC for a custom analysis.

Overcoming Barriers to Entry

Many potential buyers in Louisiana hesitate because they believe they need a massive down payment or perfect credit. This is a myth that delays financial freedom.

At Max Mortgage, LLC, Charles Parharm specializes in a variety of loan programs designed to make homeownership accessible:

FHA Loans: Ideal for first-time buyers, requiring as little as 3.5% down and offering flexible credit requirements.

VA Loans: A powerful tool for our veterans and active military, offering 0% down payment options and no private mortgage insurance (PMI).

USDA Loans: For eligible rural and suburban areas, offering 100% financing.

Conventional Loans: Competitive rates for borrowers with stronger credit profiles, with down payments as low as 3% for first-time buyers.

If you are currently renting because you think you cannot afford to buy, you might be surprised. In many cases, your mortgage payment could be comparable to or even less than your current rent.

Actionable Steps to Start Your Journey

Check Your Credit: Understand your credit score. If it needs work, we can provide guidance on what lenders are looking for.

Get Pre-Qualified: Before you look at homes in Timberlane or New Orleans, find out your purchasing power. Visit our Loan Process page to get started.

Budget for the Full Picture: Remember to factor in maintenance and insurance. Our team at Max Mortgage helps you estimate these costs accurately so there are no surprises.

Assemble Your Team: You need a trusted loan officer and a knowledgeable real estate agent. Charles Parharm has been helping customers afford the home of their dreams for many years and can connect you with the right professionals.

Conclusion: Your Legacy Begins at Home

Homeownership is the beginning of financial freedom because it changes your financial trajectory from paying for temporary shelter to investing in a permanent asset. It stabilizes your living costs, forces you to save, and builds a nest egg that can change the lives of your children and grandchildren.

Whether you are looking to buy your first home, upgrade to a larger property, or invest in real estate in Timberlane, Louisiana, the team at Max Mortgage, LLC is here to guide you. Don't let another year of rent payments prevent you from building your own wealth.

Ready to Build Your Wealth?

Stop paying your landlord's mortgage and start building your own equity today. Contact Charles Parharm at Max Mortgage, LLC for a personalized consultation.

Call: (504) 584-8999

Email: charles@callthemax.com

Apply Online: Get Started Now

Frequently Asked Questions (FAQs)

1. Do I need a 20% down payment to buy a home in Timberlane, LA?

No, you do not. While putting 20% down eliminates Private Mortgage Insurance (PMI), many buyers use FHA loans (3.5% down) or Conventional loans (as low as 3% down). Veterans may qualify for VA loans with 0% down. Max Mortgage, LLC can help you find the program that fits your savings.

2. How does owning a home help with inflation?

When you have a fixed-rate mortgage, your principal and interest payments remain the same for the life of the loan (15 or 30 years). While rents typically increase with inflation every year, your housing cost remains stable, which actually makes your housing "cheaper" in real dollars over time as your income rises.

3. What is the difference between "Pre-Qualification" and "Pre-Approval"?

Pre-qualification is an estimate of what you might be able to borrow based on self-reported information. Pre-approval is a more formal process where the lender verifies your income, credit, and assets. In a competitive market like New Orleans and Gretna, having a pre-approval letter makes your offer much stronger to sellers. Learn more about the process here.

4. Is it a good time to buy a home in Louisiana given current interest rates?

Real estate is a long-term investment. While rates fluctuate, waiting for the "perfect" rate often means missing out on years of equity building and home price appreciation. Additionally, if rates drop in the future, you can often refinance your loan to a lower rate, but you cannot go back and buy the home at yesterday's prices.

5. Can I use a reverse mortgage to help with financial freedom in retirement?

Yes. For homeowners aged 62 and older, a Reverse Mortgage (HECM) allows you to convert a portion of your home equity into cash without having to sell the home or make monthly mortgage payments. This can be a vital tool for aging in place and maintaining financial independence in retirement.

About Max Mortgage, LLC

Max Mortgage, LLC is your trusted mortgage professional in New Orleans, Jefferson Parish, and surrounding areas, servicing Louisiana, Texas, and Alabama. We specialize in providing loan solutions tailored to suit your unique needs, from FHA and VA loans to Reverse Mortgages.

Contact Information:

Charles Parharm

419 Lapalco Blvd, Gretna, LA 70056

Phone: (504) 584-8999

Email: charles@callthemax.com

NMLS: 1446745

Disclaimer: This blog post is for informational purposes only and does not constitute financial or legal advice. Loan approval is subject to credit and income verification. Rates and terms are subject to change. Max Mortgage, LLC is an Equal Housing Opportunity.