First-Time Buyers in Timberlane: Why Waiting for "Perfect" Rates Could Cost You Thousands

Discover why waiting for the “perfect” rate could cost first-time buyers in Timberlane. Learn a smart, local approach to buying now with Max Mortgage, LLC.

If you are a first-time homebuyer in Timberlane, Louisiana, or the surrounding Westbank areas like Gretna and Harvey, you have likely found yourself in a common dilemma. You find a home you love, but then you look at current mortgage rates and hesitate. You might tell yourself, "Maybe I should wait until next year when rates come down."

It is a logical thought process, but in the world of real estate finance, logic doesn't always align with market reality. At Max Mortgage, LLC, we have seen this cycle repeat itself for decades. While the instinct to save money on interest is sound, sitting on the sidelines often results in paying a higher purchase price, facing stiffer competition, and missing out on valuable equity.

Here is the reality: The "perfect" time to buy is rarely when the market feels comfortable for everyone else. This guide will explain why waiting for rates to drop is a risky strategy for first-time buyers in Timberlane and how you can use the current market to your advantage.

The "Cost of Waiting" Trap

The biggest misconception among first-time buyers is that a lower interest rate automatically equals a lower monthly payment or a better financial decision. This ignores one critical factor: Home Price Appreciation.

Real estate in desirable communities like Timberlane and the greater Jefferson Parish area tends to appreciate over time. If you wait 12 to 18 months for interest rates to drop by 1%, home prices may rise by 5% to 10% during that same period.

Consider this scenario:

Buying Now: You purchase a home for $300,000. You secure the asset price today.

Buying Later: You wait a year. Rates drop, but that same home is now listed for $315,000 or $320,000 because inventory is tight and demand has increased.

By waiting, you are often financing a larger loan amount. This can negate the savings from a slightly lower rate. Furthermore, you have lost a year of amortization (paying down your principal) and a year of appreciation (growth in your home's value).

The Competition Factor: Why You Should Buy When Others Are Scared

Do you remember the housing market in 2020 and 2021? Rates were historically low, but the buying experience was a nightmare for many. Buyers were waiving inspections, paying $20,000 over the asking price, and competing in bidding wars with 15 other offers.

When rates drop, buyers flood the market.

Right now, in Timberlane and across the New Orleans metro area, the market is more balanced. As a buyer, you currently have leverage that disappears in a low-rate environment. In the current market, you can often:

Negotiate the Price: Sellers are more willing to listen to offers below the asking price.

Get Seller Concessions: You can ask the seller to pay for your closing costs or pay for a "rate buydown" (temporarily lowering your interest rate for the first 1-2 years).

Keep Your Contingencies: You can insist on a thorough home inspection and appraisal without fear of losing the house to a cash buyer who waives everything.

If you wait for rates to hit a "magic number," you will likely find yourself back in a bidding war, paying over the asking price and losing all negotiating power.

"Date the Rate, Marry the House"

This is a phrase we use often at Max Mortgage, LLC because it perfectly summarizes the smart strategy for today's market.

Your mortgage interest rate is not permanent. You can change it. However, the purchase price of your home is permanent. You can never go back and buy a home at last year's price.

The Strategy:

Buy the home now to lock in the price and start building equity.

Refinance later when rates drop.

If rates go down in 2025 or 2026, you can simply refinance your mortgage to lower your monthly payment. If rates go up, you will be glad you locked in your rate when you did. Either way, you own the asset.

Local Insight: The Timberlane & Westbank Advantage

Real estate is hyper-local. While national headlines talk about general trends, buying in Timberlane, Gretna, or Harvey requires local expertise.

Insurance Considerations

One of the biggest hurdles for buyers in our region is the cost of homeowners insurance. However, as Charles Parharm notes, the Westbank often offers a distinct advantage. Many neighborhoods in Jefferson Parish, including parts of Timberlane and Terrytown, are in more favorable flood zones (often X-zones) compared to other parts of the New Orleans metro area.

Waiting to buy could mean facing higher insurance premiums later if carriers adjust their rates or if flood maps change. Locking in a property now allows you to understand your total housing expense immediately. At Max Mortgage, we help you factor in insurance estimates early in the pre-approval process so there are no surprises.

Comparison: Waiting vs. Buying Now

Let’s look at the numbers. This table illustrates why waiting for a rate drop might not save you money in the long run.

Scenario Home Price Interest Rate Competition Level Equity Gained (Year 1) Buy Now (Current Market) $350,000 Current Market Rate Low (Negotiating Power) Yes (Appreciation + Principal Paydown) Wait 1 Year (Projected) $367,500 (+5% Growth) 1% Lower High (Bidding Wars) None (100% Interest to Landlord)

*Note: Figures are for illustrative purposes. Contact Max Mortgage for a custom analysis based on today's live rates.

Action Plan for First-Time Buyers in Timberlane

If you are ready to stop renting and start owning, here is your step-by-step plan to navigating this market without waiting for rates.

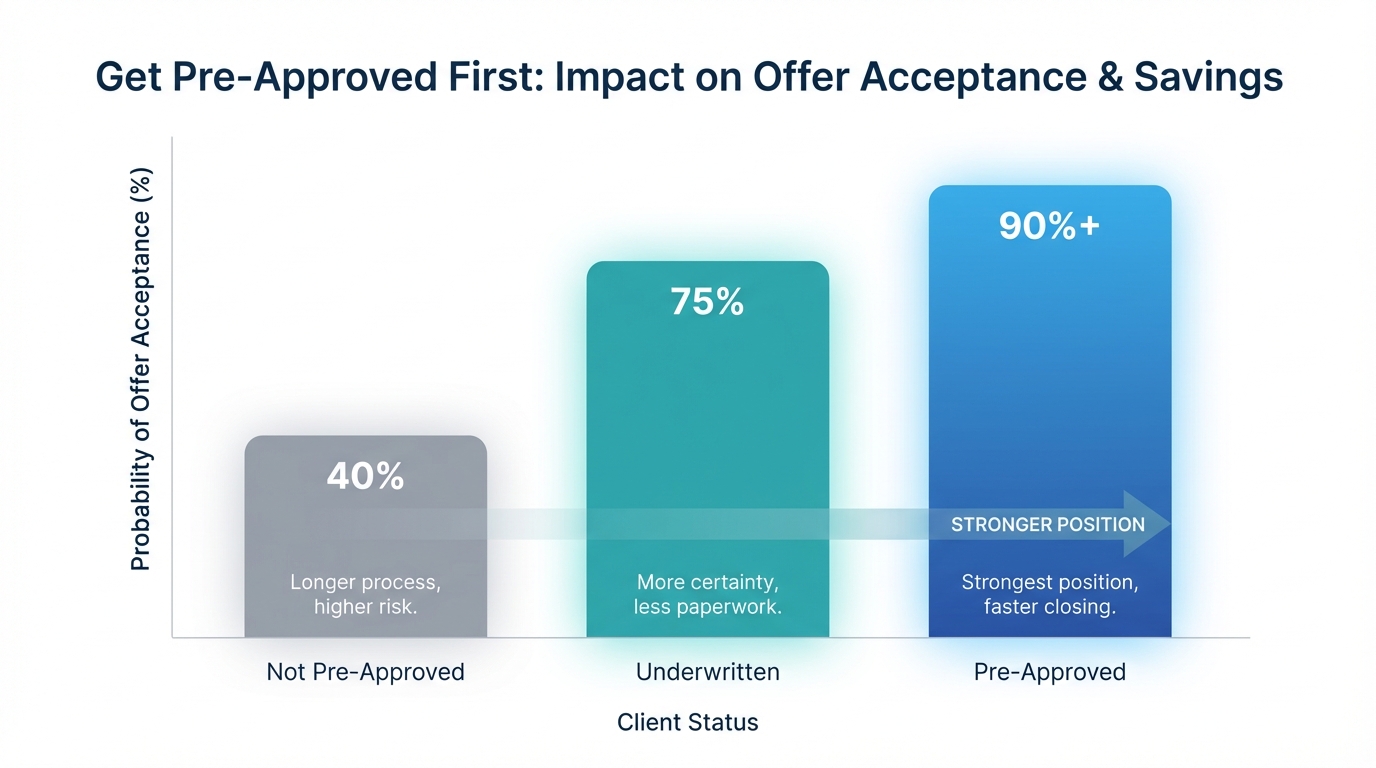

1. Get Pre-Approved First

Before you look at a single house in Timberlane, you need a solid pre-approval. This tells sellers you are serious and helps you understand your budget. We offer fast approvals for FHA, VA, USDA, and Conventional loans.

2. Explore Down Payment Assistance

Many first-time buyers assume they need 20% down. This is false. FHA loans require as little as 3.5% down, and for qualified veterans, VA loans offer 0% down. There are also local Louisiana grant programs available.

3. Check Your Credit

Your credit score influences your rate. If your score needs work, don't guess—let us review it. Sometimes paying down a single credit card can boost your score enough to qualify for a better tier. Learn more about mortgage basics and credit here.

4. Budget for the "Full" Payment

Remember to calculate Principal, Interest, Taxes, and Insurance (PITI). As local experts in Gretna and Harvey, we can give you realistic estimates for property taxes and hazard insurance in the 70056 zip code and beyond.

Frequently Asked Questions (FAQs)

1. If I buy now and rates drop next year, is it expensive to refinance?

2. Is Timberlane a good area for first-time homebuyers?

Absolutely. Timberlane offers a unique blend of established community feel, larger lots, and access to the golf course and amenities, all while being just minutes from downtown New Orleans. It provides a suburban feel with city convenience, often at a better price point per square foot than Uptown or Metairie.

3. What credit score do I need to buy a home in Louisiana?

While requirements vary by loan program, FHA loans generally allow for credit scores as low as 580 with a 3.5% down payment. Conventional loans typically require a score of 620 or higher. At Max Mortgage, we work with borrowers with various credit profiles to find a solution.

4. Should I wait for the housing market to crash?

Waiting for a crash is a gamble that rarely pays off. Unlike 2008, today's lending standards are strict, and homeowners have record amounts of equity. This stability suggests that a crash is unlikely. Instead, we are seeing a return to normal appreciation. Waiting usually just means paying a higher price later.

5. How much money do I really need to close on a house?

Beyond the down payment (which can be as low as 3-3.5%), you will need funds for closing costs (title fees, recording fees, pre-paid insurance). However, in the current market, we are successfully helping many buyers negotiate with sellers to cover some or all of these closing costs.

Stop Renting and Start Owning Today

The "perfect" time to buy is when you are financially ready. Trying to time the market is stressful and often expensive. By acting now, you secure your home price, start building your own net worth instead of your landlord's, and position yourself to refinance when the market shifts.

At Max Mortgage, LLC, we specialize in helping first-time buyers in Timberlane, Gretna, Harvey, and throughout Louisiana navigate these decisions with confidence. We offer transparent communication, speed, and modern technology to get you to the closing table.

Don't wait for rates to dictate your future.

Contact Charles Parharm today at (504) 584-8999 or email charles@callthemax.com to get your custom rate quote and start your journey to homeownership.

Max Mortgage, LLC | NMLS: 1446745 | 419 Lapalco Blvd, Gretna, LA 70056

Disclaimer: This blog post is for informational purposes only and does not constitute financial or legal advice. Interest rates and loan programs are subject to change without notice. Please consult with a qualified mortgage professional for your specific situation.